Abhishek Kushwaha

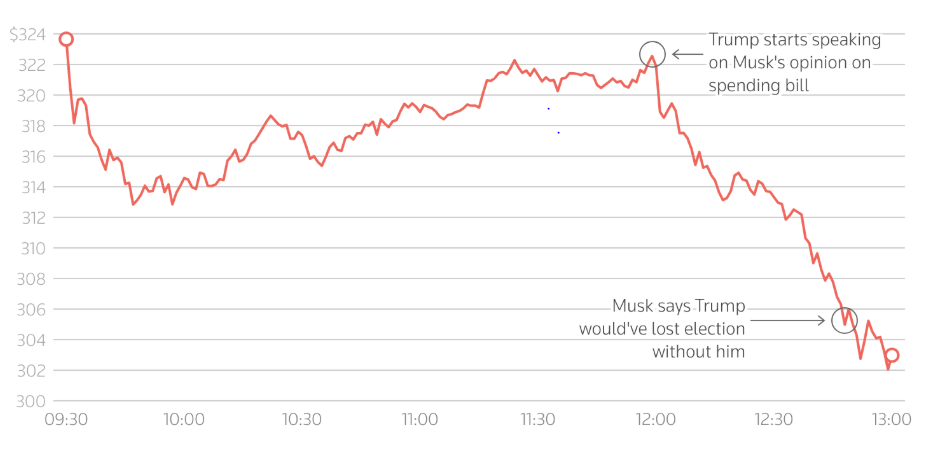

Tesla’s stock took a major hit on Thursday, dropping 14% in one day. This sharp fall wiped out around $150 billion from the company's market value, even though there was no major company news to explain the drop. The reason? A public conflict between Elon Musk and President Donald Trump.

Musk, Tesla’s CEO and one of the world’s richest men, got into a heated exchange with Trump after criticizing the president’s new tax bill. Trump fired back, saying Musk was angry because the bill cuts tax breaks for electric vehicles (EVs).

Reference: Reuters

This fight has raised serious concerns for Tesla. The U.S. government plays a big role in approving vehicle technology, especially for self-driving cars. Tesla, which plans to produce robotaxis without steering wheels or pedals, needs federal approval for such designs. On top of that, U.S. regulators are already investigating Tesla’s Full Self-Driving (FSD) system after a deadly accident.

One Tesla investor, Dennis Dick, pointed out that Musk’s changing political stance is damaging the stock. “First he supported Trump and upset many Democrats. Now he’s against Trump,” Dick said.

Over the past year, Musk has shifted Tesla’s focus toward fully autonomous vehicles. He has said that investors should only hold Tesla stock if they believe in its robotaxi future. Analysts at Wedbush estimate Tesla’s self-driving and AI efforts could eventually be worth $1 trillion.

However, Musk’s clash with Trump might now work against him. Ross Gerber, a Tesla investor, warned that the fight might lead to more regulatory pressure and government investigations. “All the advantages Musk had could now turn into problems,” he said.

Trump also suggested on his Truth Social platform that the government should cut off all subsidies and contracts related to Musk, saying it would save "billions."

Musk recently stepped back from his government role in the Department of Government Efficiency (DOGE) to focus more on his businesses. His fortune dropped by around $27 billion following Thursday’s stock crash, leaving him with an estimated net worth of $388 billion, according to Forbes.

Meanwhile, the U.S. Transportation Department is already loosening some rules for self-driving cars, but Tesla may still face tougher challenges. Most autonomous car makers use advanced sensors like radar and lidar, while Tesla depends only on cameras. Experts warn that new rules might favor other companies, leaving Tesla at a disadvantage.

Tesla’s stock has been volatile since Musk endorsed Trump’s re-election bid in July 2024. The stock soared 169% through December, then fell 54% by April due to growing public backlash, especially in markets like California, Europe, and China.

Adding to the pressure, Trump’s new budget plan includes ending the popular $7,500 tax credit for EVs by 2025. Tesla could lose over $1.2 billion in annual profits, along with $2 billion in regulatory credits if new Senate legislation also passes.

Despite all this, Tesla remains the world’s most valuable car company, with a market worth over $1 trillion before Thursday’s drop, far ahead of Toyota’s $290 billion.

Still, experts are growing more cautious. Steve Sosnick from Interactive Brokers said, “Political support used to help Tesla, but now it's causing trouble.” And Bob Doll, from Crossmark Global Investments, added, “I just don’t understand Tesla’s high stock price. It seems overvalued and overhyped.”

साझा अर्थ संवाददाता